"Our investments are chosen on the basis of value, not popularity."

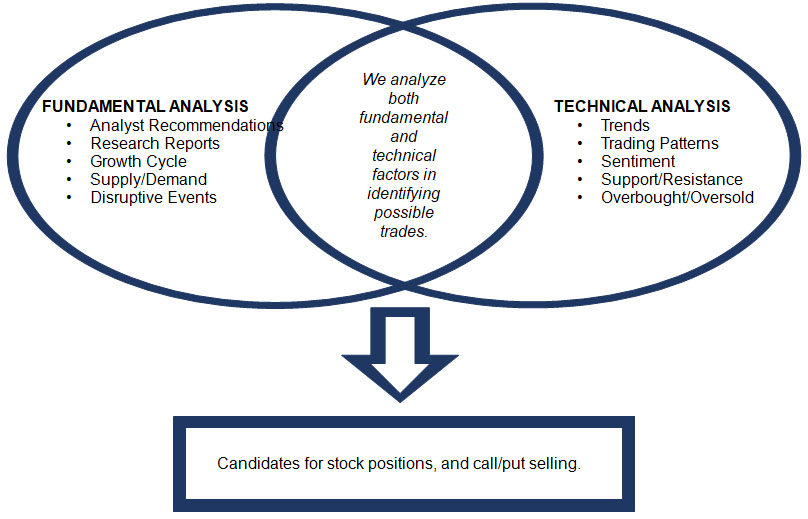

We employ a rigorous investment process to screen for trading opportunities. We analyze both fundamental and technical factors to identify potential investment opportunities. Consistent with the value contrarian philosophy, we look for fundamentally strong and recognized brand businesses, with a history of dividend growth, that have experienced a drop in their stock price. Whether the drop in stock price is due to negative news, sector rotation, or excessive pessimism it allows us the ability to essentially buy shares at a discount to their intrinsic value and provides us a "margin of safety." In addition, we utilize options to further enhance our core strategy, by selling puts or covered calls to generate income and increase alpha. Finally, we use technical analysis to provide us with timing to determine entry and exit points for trades. Purchasing distressed stocks and selling them after the company recovers can lead to above average returns.